The valuation of this company is not set in stone, due to it’s very nature and complexion:

The nominal value at the moment of incorporation at the notary is a standard administrative procedure and does not reflect the value of any company.

1 Share = € 1

The typical method used by an accountant of an SME is by deducting the liabilities from the assets in the latest and most recent annual statement. This method, typically does not account for any value bound to earnings in the past or future (Goodwill).

A value investor on the other hand, will require a market average “multiple” for companies of comparable size in the same sector in order to multiply the annual profit or EBITDA based on the average of the last 3 fiscal years, and estimate an earn back period.

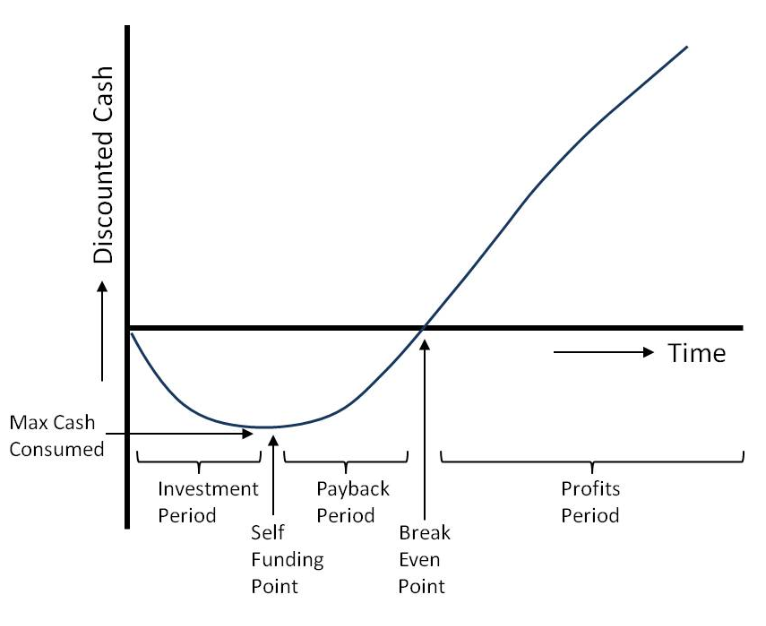

Another method is to study the future forecase and do a Discounted Cash Flow (DCF) analysis, perhaps with an additional best and worst-case scenario or various statistical simulations.

Discounted Cash Flow (DCF) analysis

In the world of scaleable software (SaaS) and medical technology valuations, year-over-year (YOY) growth is taken into account in a hockey-stick like explosive growth prognosis. This approach ultimately kills 90% of the ventures it invests in, with great loss to patients and the healthcare eco-system as a whole. We believe in a more genuine, unrefined, approach, for a natural life-cycle of medical innovation.

In the case of a strategic investor or buyer, this value will be higher…

due to potential synergies in the future.

Yet, in the eyes of patent creators and innovative product development, the total cost of with the R&D&I development is considered a rough estimate of the price that any market entrant would require in order to develop the same competitive advantage. Others would consider this method as “sunk cost”.

In the case of enlisting as a public company anywhere in the future, this obscure and private nature will finally change, clearing up the skies above the company value, with a clear market cap calculation based on the day rate of the price of 1 share. However, that might be empaired in times of volatile markets or popularly affected by media attention such as press releases either creating hyped bubble due to anticipations, or a negative image due to journalist criticism, going in the opposite direction. Therefore, Prime Banks and Institutional Lenders, create their own valuations internally, and consult a risk analysis, even after publicly listing.

TLDR

In short, we will not make any assumption with regards to the actual company valuation, and leave that up to you, as beauty is only in the eye of the beholder.

Theme music: “11pm” (https://soundcloud.com/pentybeats/11pm) by penty (https://soundcloud.com/pentybeats). Available for use under the CC-BY-SA 3.0 license (creativecommons.org/licenses/by/3.0/), at SoundCloud (https://soundcloud.com)